At this moment in time nobody has any idea how Brexit will pan out and whether indeed we might see a change in the UK government. What we do know is that the timber industry is readying itself for changes which could in theory impact cash flow and the cost of imported wood. However, there are already procedures in place to mitigate any cash flow issues and, as you will see below, under World Trade Organisation tariffs there is no duty on the more popular type of logs imported into the UK.

VAT bombshell averted

Under the current European free-market arrangement, UK companies importing wood are allowed to offset their VAT liabilities until they have sold their products into the market. This assists massively with cash flow, some projections suggest it saves £1 billion a year in additional cash flow, and is something which the UK government has already addressed. Despite the fact that the UK will likely be outside of the European Union the government has agreed that the 20% VAT charge on business to business wood imports can be deferred – as it is under the current system.

There were concerns that the potentially enormous impact on cash flow would push many businesses into financial distress and reduce competition within the industry.

Import/export documentation

While the UK timber industry is already familiar with the type of documentation that would be required for imports/exports to the European Union in the future, there will be time delays. Some experts believe that wood deliveries could be delayed by up to a week due to the additional paperwork. Whether or not this turns out to be the case, any delay would in theory increase costs which would need to be passed on to businesses and consumers.

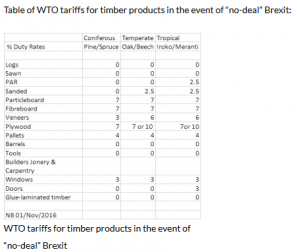

When taking into account all types of wood, the UK imports a staggering £7.9 billion per annum and exports £1.9 billion per annum. Unfortunately, some areas of the wood market will attract additional World Trade Organisation tariffs in the future. Thankfully logs are not one of them!

UK log industry

In will be interesting to see how the domestic forestry sector adapts and reacts to the various elements of Brexit. Will we see the government introducing an array of financial incentives such as those seen in years gone by? Would UK forest management companies be able to maintain relatively low costs in the future?

At this moment in time it is difficult to see how Brexit could lead to a significant increase in the cost of wood fuel for your wood-burning store. Indeed, the forthcoming trading changes with the European Union may well prompt the UK authorities to reinvest back into what was traditionally a tax efficient sector.

Summary

It looks as though the potential VAT bombshell has been averted, World Trade Organisation tariffs are set at zero for logs but processing times may be extended when the UK leaves the free market. Quite how the UK domestic forestry industry will react remains to be seen but there must be potential for long-term growth? At the moment it seems as though concerns about an increase in the cost of wood fuel in the UK may have been overdone.